I recently had a conversation with a friend working in a well-known bank in Mauritius. The topic? Why do we still have unsatisfied customers and long queues in banks when we are moving in the digital era? Is it because the adoption process of new technologies is relatively low or is it about the experience or even a lack of education?

This conversation fueled my digital marketing mind with a lot of functional questions and an urge to find out answers as to what is really the future of banking in Mauritius and how should banks address it? To add on to the thinking process, my current learning process of digital maturity.

In this LinkedIn post, I will elaborate on 3 main components that Mauritian banks should explore and optimize in 2018. For sure, while some of these points might be relevant to your organization, for others it might not. It all depends on your current aspirations for 2018. If it is going digital, then these will make sense to you.

#1 Integrated Customer Experience

In a world where information has become a commodity, consumers are disrupting and wandering out of traditional funnels which are considered too rigid. The amount of information heightened the expectations of the lamda bank account holder so much so that customer loyalty has become quite a rare achievement.

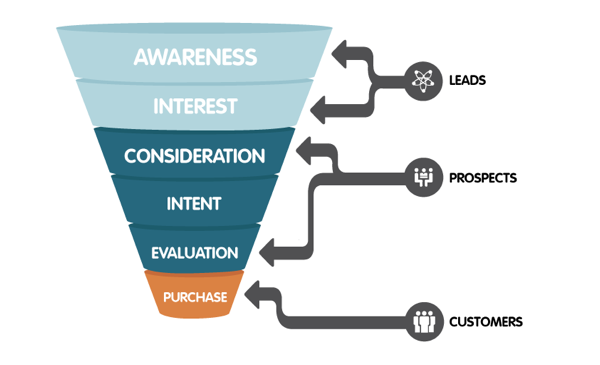

So, how to proceed with reducing the number of wanderers and increase your conversion throughout your marketing funnel. The answer is having an integrated customer experience. But, first, let’s elaborate on the marketing funnel so that we are clear on the why of having a defined integrated customer experience.

We’ve all been accustomed to seeing customer marketing funnels as a linear movement towards the purchase of a product or a service. While this iconic marketing model has been widely used across industries and most precisely banks, this is slowly becoming irrelevant considering the amount of distraction happening online.

So, we went from linear funnel where we considered distractions as minor elements throughout the journey.

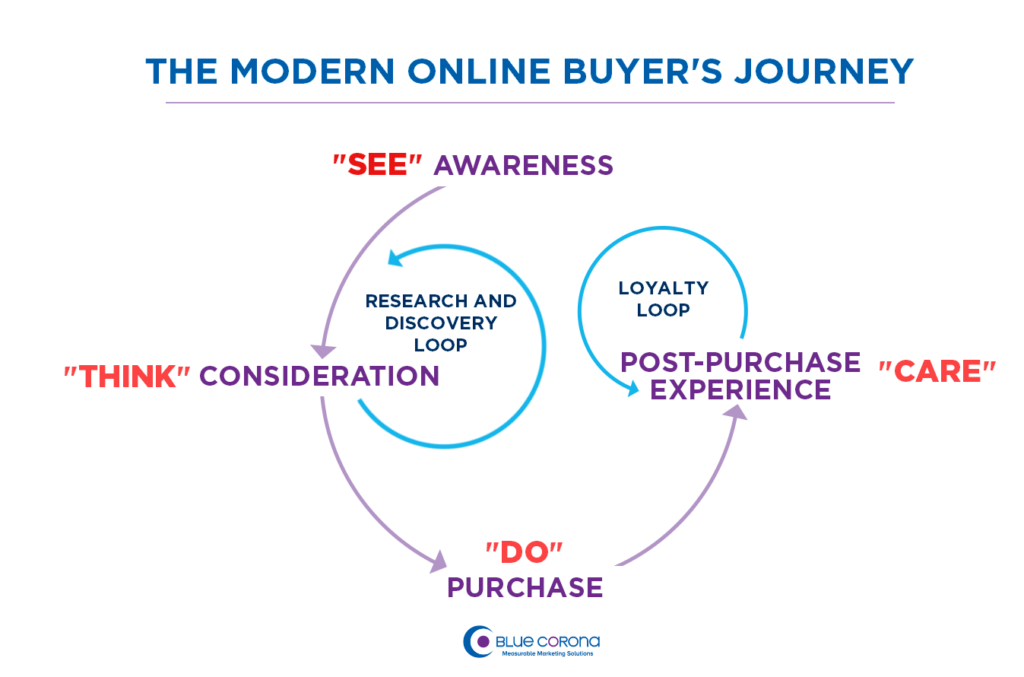

To circular customer marketing funnels where much focus was put on the overall experience and its different elements surrounding it.

What is in for banks? The shift from a linear to a circular journey resulted in customers contacting brands at different stages of their journey and using any point of contact; be it online or offline. For instance, the new generation of customers wants a seamless experience with regards to paying and consuming other bank services. As such, having an integrated experience is a must for banks

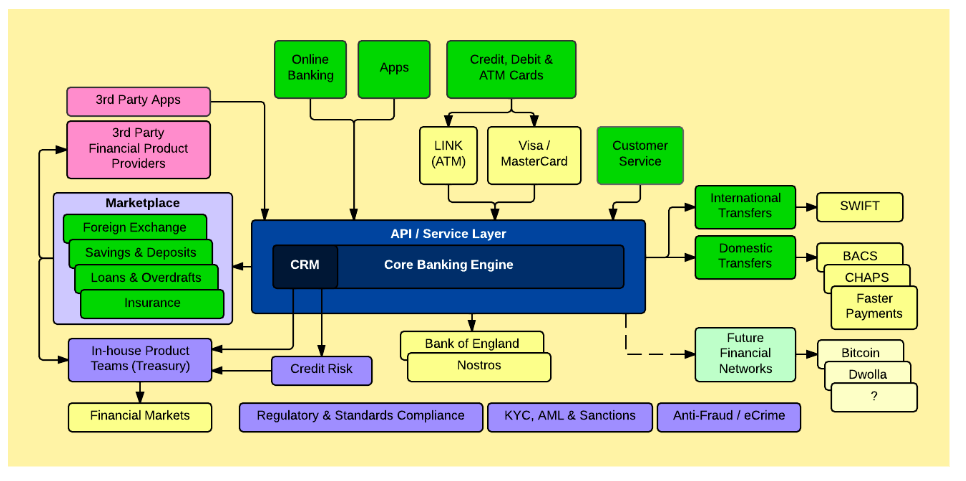

We can’t speak of integrated experience without mentioning the technology associated with it. In fact, technology backs any digitization and automation projects within the banking context. However, with the shortening of technology upgrades, banks will be pushed to adopt cloud solutions to service clients. Hence, no more of static or on-premises systems.

I like to believe that we are in an interesting phase of digital banking where there is a focus on optimizing the current services and products. The next phase is surely going to be about collecting massive amount of data about customers and creating personalized experiences through advanced profiling.

As such, the traditional banking ecosystem as we know it is changing to include more devices and touchpoints. As pointed out in this article, the banking integrated ecosystem is becoming far much complex yet banks are focusing on creating a seamless and smooth experience which is 1. Cross-channel, 2. Fast, 3. User-Friendly and 4. Secure.

#2 Fintech and Payment

Lately, we’ve been hearing a lot of how the banking industry is being disrupted with Fintech trends and new modes of payment such as cryptocurrencies and blockchain. I like to believe that these two are closely related; you can’t possibly have an innovative way of payment while you are limiting yourself in Fintech.

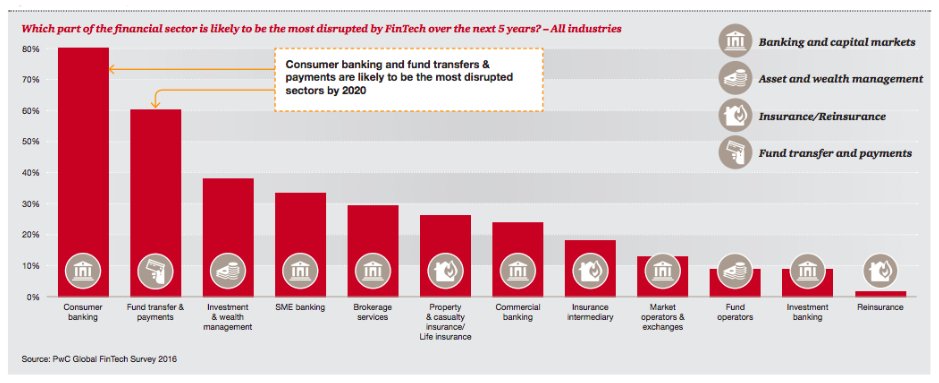

According to a Global FinTech report survey done by PwC in 2016, Consumer banking was considered the top financial sector to be disrupted by new FinTech over the next 5 years.

As compared to India which saw a massive investment of $1.5Bn in Fintech start-ups, Mauritius is not there yet. We are still in the first phase of optimizing our current products and services to meet the lamda customer.

On top of new technological trends shaping how we make payments, cross borders trades and workforce mobility will require banks to provide a connected, extended, easy to access and customer-oriented. Added to these, banks will surely be in tough competition with already settled non-banking organizations.

For example, Google, Facebook, and YouTube which accounts for over ¾ of the world population are investing massively in providing purchasing and payment facilities to their end users as well as to businesses. As a matter of fact, these brands will slowly sway customers away from traditional banking.

For example, you can now purchase directly onto Facebook and Google which are both offering innovative solutions to businesses and retailers. Suffice to say that these platforms have invested in providing data analysis features for brands to provide customized services through machine and deep learning strategies.

#3 Digital Transformation of banks

The two previous points spoke about external trends pushing banks to reinvent themselves to service high expectations of customers. However, we can’t meet the needs and preferences of customers if our internal services are not optimized to do so.

As per a study that was done by Capgemini in 2016, it was pointed out that 87% of banks believe their core systems were not ready to handle the digital disruption in the banking ecosystem. For some time now, banks have undergone digital transformation as a way to align their activities with the current digital trends mentioned earlier.

There are few models which are being used, but I believe the core elements of banks should include;

- People – How well verse is the bank employees ready to service new expectations while making the most of digital tools.

- Technology – How deep is the use of technology to ensure customization of experience, automation, artificial intelligence, machine learning among other components to facilitate the daily operations.

- Customer Centricity – How far do banks invest in the design thinking process to craft extendable, memorable and useful customer experiences.

- Infrastructure – Does the bank have the required infrastructure to respond to customer mobility needs, seamless experience, and technology-driven initiatives.

I personally don’t believe in a linear digital transformation but an agile way of doing things which allows for more optimization of the processes as well as an expandable way of doing things.

My final words

As a digital marketer, I believe the banking sector in Mauritius is on the verge of transforming how we consume services and products. With technology as a backbone, Mauritians will expect more from businesses. As I mentioned, information is now a commodity and as such, the choice factor shifted back to the customer and as we say customer is king. Saying this, banks should be on the edge of the latest trends and start preparing themselves for the banking disruption waves.

What are your thoughts about my 3 points that banks should watch out? Let’s engage in a conversation.